Has anyone pitched working with Tether to bring XAUT (Tether Gold) on Berachain? I believe it would require a governance vote to bring on Tether Gold, but it seems like a great opportunity to pitch to Tether. Ideally it would also include some kind of spend where they push validator rewards to an XAUT-Honey pool, and likely also whitelist USDT as a Honey asset.

It just seems odd that Berachain really hasn’t partnered with Tether yet when it could be a pretty easy distribution and liquidity partner, especially for their Tether Gold product. No one really seems to use it across the DeFi ecosystem, and Berachain would likely be a solid opportunity for them to distribute the asset to retail consumers.

Some rough numbers is currently Tether Gold has about $810M in market cap with $17M in volume. It’s very low numbers but if they actually marketed it more and promoted it’s use, it could be a nice ecosystem asset within Berachain. The POL system is sort of exactly designed for sourcing this kind of liquidity, and I imagine Tether’s only reservation would be Berachain is too small, but the reality is they don’t seem to be doing anything with Tether Gold. I’m not even sure most people in DeFi knows it exists. You can’t find any liquid derivatives markets on it except for spot, even though it’s Gold backed.

Just a thought.

1 Like

Kodiak has pitched this to XAUT0 team and are ready to provide liquidity incentives. We think Tether Gold is well positioned to grow, and especially with the XAUT0 (similar to USDT0) cross-chain product it’s easy to technically integrate. Tether Gold’s team is also quite keen and expressed interest in bringing a “lot of TVL” if it were incentivized (as we would with POL).

It seems normally there is a chain level integration fee, but given USDT0 is already on Berachain, it may not be needed. That said, USDT0 growth on Berachain (eg integration in Honey, etc) may be a pre-requisite priority before investing resources in growing another product. Ball is in the court of foundation and tether gold team to move on next steps.

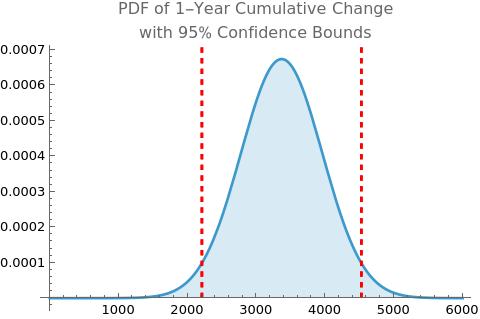

I would like to add a quick quantitative analysis on this simulating the performance of a concentrated Kodiak Island position. This is a rough analysis using Uniswap V3’s paper and supplying gold’s price and current volatility. Below is a monte carlo style simulation of Gold price for about 1 year.

| 95% Confidence Quantiles |

Price |

| Current |

3368.48 |

| High |

4527.8 |

| Low |

2209.16 |

From this, I have included a 95% confidence range of the gold price. Clearly the assumptions are based on constant volatility which shouldn’t necessarily be taken as a full guarantee. In any case, it is a good starting point, and by taking these ranges, I have computed the impermanent losses in percent using Uniswap V3 formulas. This gives LPs a way to infer potential losses at the edge of the range for a position with a low price and high price at these prices. This will give managers implementing this strategy an idea of the worst case Impermanent Loss at these positions.

| Uniswap Position |

Price |

Percent Change |

Impermanent Loss vs. Hold |

| Lower Bound |

3368.48 |

-15% |

- 10 % |

| Higher Bound |

4527.8 |

+18% |

- 10 % |

Note this table assumes a start of 1 ounce of Tether Gold and matching dollar amount utilizing the 95% bounds. If we take the Impermanent loss as a possible minimum BGT yield to cover, assuming $500K of supplied liquidity, we would need only around $50K in incentives to compensate LPs for worst case losses.

As Berachain is marketing itself as a DeFi chain, we could monitor the performance and efficiency of the liquidity, along with it’s interactions with BGT. Pushing for either Kodiak or Tether themselves to sponsor their own validator to push emissions to their pool could start a profitable liquidity sink for LPs engaging in the gold AMM and drive capital efficiency of the pool (Volume / TVL) and become a marketable campaign for both Tether and the Berachain ecosystem, especially if the partnership expand’s Tether Gold’s userbase. Currently no L2 systems have any meaningful Tether Gold liquidity depth and could be a meaningful opportunity for all partners if Tether commits to incentive distribution to compete for capital.